In a world where financial emergencies can strike unexpectedly, having access to quick cash can be a lifesaver. But what if you could secure a loan using an asset as timeless as time itself? That’s where loans on watches come into play. In this article, we’ll delve into the intricacies of securing a loan on your beloved timepiece, exploring everything from how it works to the risks and rewards involved.

Table of Contents

How Do Loans on Watches Work?

Eligibility Criteria

Securing a loan on a watch typically requires you to meet certain eligibility criteria. While these criteria may vary depending on the lender, they often include factors such as the brand, model, and condition of the watch.

Evaluation Process

Once you’ve met the eligibility criteria, loan on watches, the lender will assess the value of your watch to determine the loan amount you qualify for. This evaluation process may involve examining factors such as the watch’s brand reputation, market demand, and condition.

Loan Terms and Conditions

After the evaluation, you’ll be presented with the loan terms and conditions, including the interest rate, repayment period, and any additional fees. It’s crucial to review these terms carefully before proceeding to ensure you understand the obligations involved.

Types of Watches Accepted for Loans

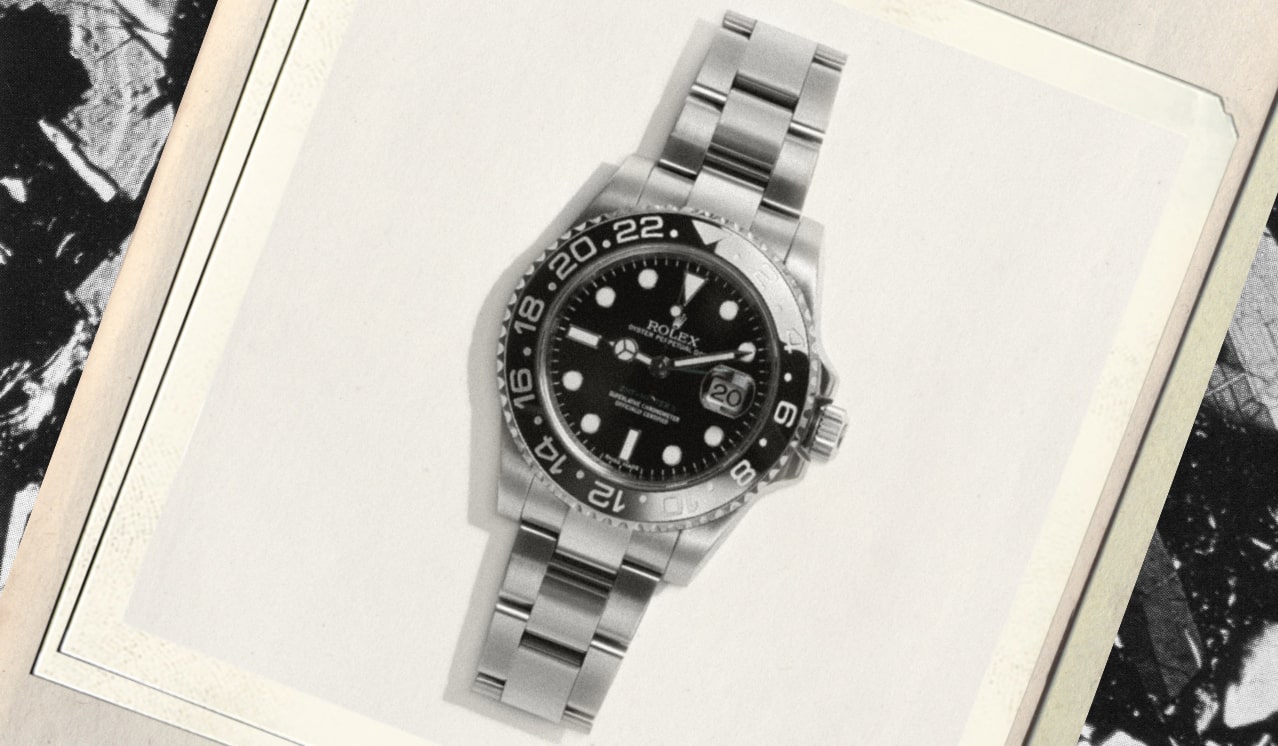

Luxury Watches

Luxury watches from renowned brands such as Rolex, Omega, and Patek Philippe are highly sought after by lenders due to their prestige and market demand.

Vintage Watches

Vintage watches, especially those with historical significance or rarity, can also be accepted as collateral for loans, provided they meet the lender’s criteria.

Limited Edition Watches

Watches with limited production runs or special editions may command higher loan amounts, sell gold Melbourne, making them attractive options for borrowers looking to leverage their timepieces.

Benefits of Getting a Loan on Watches

Quick Access to Funds

One of the primary benefits of securing a loan on a watch is the expedited access to funds. Unlike traditional loan applications that may take days or even weeks to process, loans on watches often provide same-day approval and funding.

No Credit Check Required

Since the watch serves as collateral for the loan, lenders typically do not require a credit check during the application process, making it an accessible option for individuals with less-than-perfect credit scores.

Retention of Ownership

Unlike selling your watch outright, securing a loan on your watch allows you to retain ownership of the timepiece while accessing the funds you need, providing peace of mind for watch enthusiasts.

Risks Involved in Taking a Loan on Watches

Possibility of Losing the Watch

One of the inherent risks of taking a loan on a watch is the possibility of losing the timepiece if you fail to repay the loan according to the agreed-upon terms. It’s essential to assess your financial situation carefully before using your watch as collateral.

High-Interest Rates

Loans on watches may come with higher interest rates compared to traditional loans due to the perceived risk involved. Be sure to compare rates from multiple lenders to secure the most favorable terms.

Impact on Credit Score

While loans on watches typically do not require a credit check, defaulting on the loan can still have negative repercussions on your credit score, making it essential to prioritize timely repayment.

Factors to Consider Before Taking a Loan on Watches

Financial Situation

Before committing to a loan on your watch, consider your overall financial situation, including your ability to repay the loan on time without jeopardizing your financial stability.

Reputation of the Lender

Research the reputation and credibility of the lender before proceeding with the loan application to ensure they are trustworthy and reputable.

Loan Repayment Terms

Carefully review the loan repayment terms, including the interest rate, repayment period, and any penalties for early repayment or late payments.

Comparison with Other Loan Options

Personal Loans

While personal loans offer flexibility and typically lower interest rates, they may require a credit check and longer processing times compared to loans on watches.

Pawnshop Loans

Pawnshop loans provide quick cash without the need for a credit check, but they often offer lower loan amounts and may require surrendering ownership of the watch.

Steps to Get a Loan on Watches

Researching Lenders

Start by researching reputable lenders who specialize in providing loans on watches, and compare their terms and rates to find the best fit for your needs.

Submitting Watch for Evaluation

Once you’ve chosen a lender, submit your watch for evaluation, providing any necessary documentation to support its authenticity and value.

Reviewing Loan Terms

Carefully review the loan terms and conditions provided by the lender, ensuring you understand all obligations before signing any agreements.

Tips for Maximizing the Benefits of Loans on Watches

Negotiating Loan Terms

Don’t be afraid to negotiate with the lender to secure more favorable loan terms, such as a lower interest rate or extended repayment period.

Proper Watch Maintenance

Maintain your watch in good condition to preserve its value and maximize the loan amount you qualify for.

Timely Repayment

Make timely repayments on your loan to avoid defaulting and potentially losing your watch.

Conclusion

In conclusion, loans on watches offer a convenient and accessible solution for obtaining quick cash while retaining ownership of your prized timepiece. However, it’s essential to weigh the risks and benefits carefully and consider alternative options before proceeding. By understanding the loan process, evaluating your financial situation, and prioritizing timely repayment, you can make the most of this unique borrowing option.